We will talk about the rest of PV in this article to complete

all previously mentioned. As usual, we use Microsoft Excel to mathematically calculate

the formulas or to insert Function to return the solution. Moreover, we will

enlarge on the certain formulas by proving the different forms around the

bottom of the page or in the link file.

As below, I provide you the picture with the description and

the link file to each item. Also note that the two new functions have been used

in the link files: EXP and Seriessum.

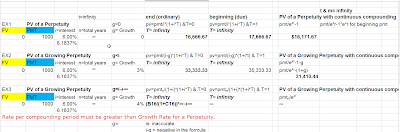

7 PV of a Growing Perpetuity (g < i) & PV of a

Growing Perpetuity (g < i) with Continuous Compounding: See item 6.

8 PV of a Growing Perpetuity (g = i) & PV of a

Growing Perpetuity (g = i) with Continuous Compounding: See item 6.

Out of the normal PV with compounding, there is the

remainder from the previous post worth mentioning, i.e. the formula about PV ofCombined FV and growing cash flow with compounding (g ≠ 0) and the formula of Uneven Cash flow withcompounding.

Check the details inside the link to see what formulas are

used and to know how to use NPV function.

Prove the different forms to the formula of an Annuity

with Continuous Compounding and to the formula of a Growing Annuity with

Continuous Compounding

Two forms to each formula have been found from the web sites

so we need to know the difference between them for the same content. The tests are

proven in the link files above for the same contents.

A) An Annuity with

Continuous Compounding:

(pmt/e^r-1)*(1-1/e^rt) Vs pmt*(1-1/e^rt)/r

Just edit r to (1+r/m)^m-1 close to e^r-1 due to

Cont. Comp. interest.

|

B) A Growing Annuity with

Continuous Compounding:

|

See the step by step

test accompanied the how-to calculation in the link file above or see the brief

test below.

((Pmt/e^g)*(1/e^r/e^g-1))*(1-e^-(r-g)t)

|

||

((Pmt/e^g)*(1/(e^r-e^g)/e^g))*(1-e^-(r-g)t)

|

||

((Pmt/e^g)*(e^g/(e^r-e^g)))*(1-e^-(r-g)t)

|

||

pmt/e^r-e^g*(1-e^-(r-g)t)

|

||

Given e^g = (1+g) moves to (1+g/m)^m

|

||

then

|

||

(pmt/e^r-(1+g))*(1-(e^gt/e^rt))

|

||

(pmt/e^r-1-g)*(1-(1+g)^t/e^rt))

|

||

How to Use Logarithm for Finding n Period

To know the rule of log and power is useful to understand

some complicated calculations around this article, particularly in this sub

heading.

|

Rule of Log

|

|

|

Rule of Power

|

||

|

log(2*3)=

log(2)+log(3)

|

|

2^(2+3) =

2^2*(2^3)

|

|||

|

0.77815

|

0.77815

|

>power of

base 10

|

32

|

32

|

|

|

log3(4/5)=

log3(4)-log3(5)

|

|

2^(2-3)= 2^2/2^3

|

|||

|

-0.2031

|

-0.2031

|

>power of

base 3

|

0.5

|

0.5

|

|

|

2log(x)

=log(x^2)

|

|

|

|

|

|

Log Calculation for PV of future sum with continuous compounding: Given PV= 657.0468198, FV= 1000, r= 6% Find the answer for n period (the number of years for making FV= 1000 worth PV= 657.0468198).

Logarithm's calculation

|

|||

PV=FV/(e^rt-1+1)

|

|||

e^rt= FV/PV

|

|||

log (e^rt) = log(FV/PV)

|

|||

rt*log(e) = log (FV/PV)

|

|||

6%*t *log(2.7182818284) =

log (1000/657.05)

|

|||

6%*t *log(2.7182818284) =

|

0.605932

|

||

6%*t =

|

0.42

|

||

t =

|

7

|

||

As for this last paragraph, I provide all of you the link of online calculator and

the link of wikipedia’s time value of money for present value in order to see

more information, calculate the numbers, and review the raised points

altogether.

No comments:

Post a Comment